As part of its effort to educate taxpayers and business owners on tax appeal processes, taxpayer rights, and the operations of the Board of Tax Appeals (BoTA) in Liberia, the board successfully concluded a one-day regional workshop in Nimba County.

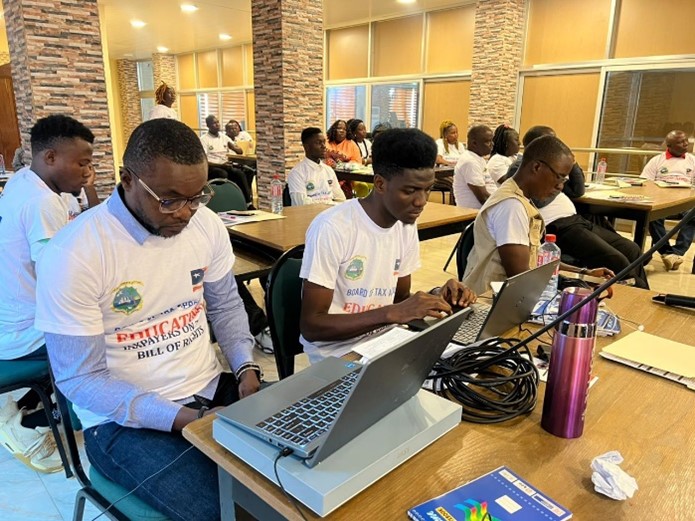

The workshop, held under the theme, “Taxpayers’ Bill of Rights”, took place at Jackie’s Resort Multi-Purpose Conference Hall in Ganta City on Monday, December 16, 2024. The event brought together local and prominent business owners, taxpayers, stakeholders, and representatives from the Liberia Revenue Authority (LRA) to provide insights into taxpayers’ rights, tax appeal procedures, and BoTA’s operations in Liberia.

During the workshop, presentations were delivered by Commissioners and Executive Members of BoTA, alongside a representative from the LRA. Topics covered included, “An Introduction to the Bill of Rights for Taxpayers”; “The Role of the LRA in Tax Collection”; “An Overview of the Tax Appeals Process”; and an interactive session with participants.

BoTA Commissioner, Cllr. David M. Kolleh, Jr., urged participants to fully utilize the taxpayers’ bill of rights, describing it as a legitimate tool designed to protect citizens under Liberia’s tax laws. He emphasized that while the government seeks to increase tax revenue, it remains equally committed to protecting taxpayers’ rights to ensure transparency and accountability in the country’s revenue system.

Representing the Liberia Revenue Authority (LRA), Cllr. Bruce Quaya provided a comprehensive explanation of the LRA’s role in tax collection. He addressed participants’ concerns regarding the tax collection process, and encouraged business owners and taxpayers to leverage the LRA’s website for prompt redress of issues. He further called for cooperation with LRA agents to improve Liberia’s tax system.

Atty. Tonia A. Gibson, Deputy Executive Director for Legal Affairs at BoTA, elaborated on the tax appeal process. He urged taxpayers to follow the proper channels within the LRA for resolving claims and, if necessary, to escalate matters to BoTA for further resolution. He assured participants that BoTA provides an accessible, efficient, and affordable due process for resolving tax disputes.

Atty. Gibson also reiterated BoTA’s commitment to maintaining an effective, transparent, and accountable system for hearing tax cases across Liberia’s fifteen counties. He announced plans for widespread public awareness campaigns in 2025 to further educate taxpayers about BoTA’s operations.

During the interactive session, participants praised BoTA for organizing the workshop and offered constructive suggestions for improving the tax collection system in Liberia.

Bessy N. Gegbeh, Proprietor of Planet 44 in Ganta City, highlighted the need for increased patronage of local businesses in Nimba County to enhance revenue collection.

Prince J. Dahn, Manager of Atlantic Investment Group Inc. in Nimba County, expressed appreciation for the workshop and emphasized the importance of continued education on taxation to encourage local businesses to contribute to Liberia’s tax revenue. He also called for closer collaboration between the LRA and the Ministry of Commerce and Industry to optimize revenue collection.

The one-day workshop marks the beginning of a series of regional workshops organized by BoTA. The up-coming workshops are scheduled as follows: Region One: Bong, Lofa, and Nimba Counties (Ganta City, Nimba County); Region Two: Maryland, Sinoe, Grand Kru, River Gee, and Grand Gedeh Counties (Zwedru, Grand Gedeh County); Region Three: Montserrado, Margibi, River Cess, and Grand Bassa Counties (Buchanan City, Grand Bassa County); and Region Four: Gbarpolu, Grand Cape Mount, and Bomi Counties (Tubmanburg City, Bomi County).

Monday’s workshop was moderated by Brisco P. Toe, Human Resource Director, with support from other staff members of the Board of Tax Appeals (BoTA).