The Financial Intelligence Unit of Liberia (FIUL), now transitioning to the Financial Intelligence Agency (FIA), has informed stakeholders and the general public of the Anti-Money Laundering and Countering the Financing of Terrorists and Proliferation Financing (AML/CFT & PF) Regime of Liberia and the on-going 2nd Round Mutual Evaluation/Peer Review of Liberia’s AML/CFT/PF Regime by the Inter-governmental Action Group Against Money Laundering in West Africa (GIABA) located in Dakar, Senegal.

The FIU disclosed that the country’s AML/CFT/PF regime is being assessed for compliance level with Financial Action Task Force (FATF) forty (40) standards and other international best practice.

Liberia is a member state of GIABA, an institution of ECOWAS and a FATF-styled regional body working with member states to ensure compliance with international AML/CFT/PF standards. The Mutual Evaluation (ME) is a peer review process during which assessed country is required to demonstrate technical compliance and effectiveness with FATF and other international AML/CFT/P standards. The technical compliance component assesses whether the necessary laws, regulations or other required measures are in force and effect, and whether the supporting AML/CFT/P institutional framework is in place, while the effectiveness component assesses whether the AML/CFT/PF system is working, and the extent to which the country is achieving set of outcomes (11 Immediate Outcomes).

According to a FIU press release, “Currently, a desk-based review of Liberia’s AML/CFT & PF laws and regulations is on-going by GIABA Assessors. The desk-based review is followed by onsite visit by GIABA Assessors, which is scheduled between the 5th–16th, September 2022 in Monrovia, Liberia. During the onsite visit, the GIABA Assessors are expected to meet with all relevant stakeholders together and or separately to ascertain the application and effectiveness (implementations) of Liberia’s AML/CFT/PF laws viz-a-viz FATF standards.”

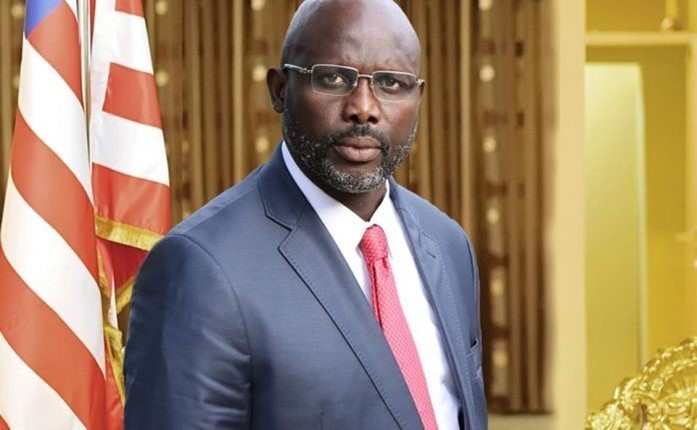

The release said, “The FIUL appreciates the strong political will demonstrated by the Government of Liberia (GOL) under the leadership of His Excellency Dr. George M. Weah on the enactment of the Financial Intelligence Agency (FIA) Act, The Anti-Money Laundering, Terrorists Financing, Preventive Measure, Proceed of Crimes Act, the Whistle Blower and Witness Protection Act, the Liberia Anti-Corruption Commission (LACC) Act, among others. It is important to note that these legislative enactments are milestone achievements and a statement that money laundering and its predicate offences (crimes), corruption, etc.; terrorists financing and proliferation financing are not tolerated in Liberia; thereby, in compliance with the technical criteria of FATF standards and very relevant to the ongoing mutual evaluation process of Liberia.

“The FIUL wholeheartedly appreciates the guidance of the National AML/CFT/PF Inter-Ministerial Committee of Liberia under the chairmanship of the Honorable Minister of Justice and Attorney General of the Republic of Liberia, Cllr. Frank Musah Dean, The Ministry of Finance and Development Planning (MFDP) Co-Chairman and the Central Bank of Liberia (CBL) Member are notably appreciated for their continued support to the AML/CFT/PF Regime of Liberia.”

The release continued, “Finally, FIUL encourages the technical working group of the mutual evaluation process to continue achieving the objectives of the process and at the same highly anticipates enhanced coordination, cooperation and participation from the IMC and all stakeholders of the AML/CFT/PF regime of Liberia including bank and nonbank financial institutions; competent authorities and law enforcement agencies; Designated Non-Financial Businesses and Professions including the lawyers, Accountants, Dealers in Precious Metals & Stones, etc. and the public at large, to enable Liberia to get impressive ratings for this Second Round of Mutual Evaluation.”